With the growing digitalisation of the economy, a CBDC is seen as a tool to mitigate risks related to the emergence of new privately-owned digital currencies and of foreign CBDCs.

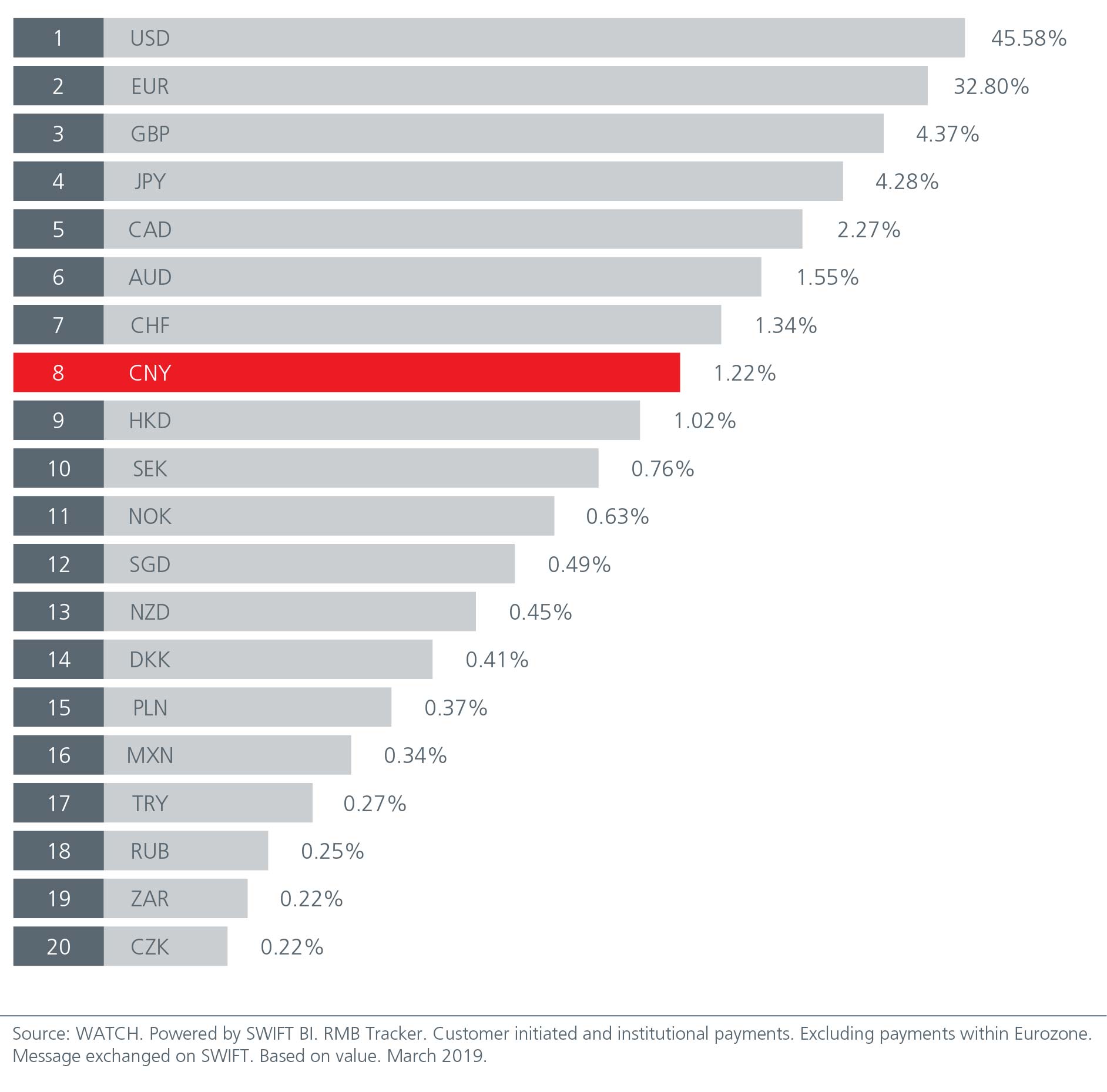

Unsurprisingly, the geostrategic dimension behind a CBDC is highly emphasised in the political narrative of all major powers. As suggested by ECB economists, this assumption could also be relevant in the event that a national central bank digital currency (CBDC) is launched, helping to explain why countries seem to be racing over the launch of public digital currencies. In the battleground of global digital competition, countries seek first-mover advantage to set standards and foster a model of development. In June 2021, the e-CNY was employed in more than 70.7 million transactions for a value of 34.5 billion yuan by 20.8 million retail users and 3.5 million corporate users. While the EU roadmap outlines an investigation phase which will end in five years, China has already introduced several pilot experiments for its e-CNY. Meanwhile, the managing director of the Shanghai-based Digital Renaissance Foundation, Cao Yin, notes that while the SWIFT-PBoC venture may raise hopes of globalizing the DCEP usage, the dollar-denominated system for financial messaging and cross-border payments, “couldn’t be relied on too much to globalize the DCEP, as a confrontation between China and the US at large is unlikely to see a 180-degree turn any time soon.Days after the European Central Bank (ECB) publicly disclosed its roadmap for a digital euro project on 24 July, the People’s Bank of China (PBoC) published a white paper describing the advancements of its plan for a digital yuan (e-CNY). SCMP reports that the joint venture emerged following concerns that the US might cut off China or Hong Kong from SWIFT and after realizing that it is difficult to develop an alternative system to SWIFT and make it gain traction as China had wanted to do with the CIPS with its 984 financial institution participants from 97 markets. It notes that the yuan’s “reserve currency status could rise further as the world further de-dollarizes, and its share among reserve currencies may reach 5% by the end of 2025 - implying a demand of over $300 billion worth of yuan” meaning the de-dollarization may spur yuan usage.Ĭautious tread despite digital yuan high hopes

Should China launch digital yuan pilot zones with its trading partners, it would in turn help lift the yuan’s status as a global settlement currency, a new Bloomberg Intelligence analysis suggests, adding that the yuan may overtake the British pound and the Japanese yen as the world’s third-largest reserve currency over the next decade. While sharing his thoughts on the Financial Services Bill which is now in the House of Lords earlier this week, a Member of the House, Chris Holmes, hints on the likelihood of China’s central bank digital currency (CBDC) being “so far advanced in this space that a digital yuan could become the de facto official digital reserve currency globally”. The venture’s move, which could serve to broaden the use of the digital yuan, will likely help promote the digital currency’s international use as it’s being speculated to rival the US dollars’ hegemony.ĭigital yuan already having a global outlookĪs a front-runner in the global race to launch a CBDC, there have been suggestions that the digital yuan is going to help China’s push in yuan trade settlement and the resumption of yuan internationalisation. China’s home-grown cross-border settlement system, Cross-border Interbank Payment and Clearing (CIPS), owns 5% while the Payment and Clearing Association of China, a self-regulatory association for the payments industry, and the PBOC’s DCRI each own 3%. SWIFT is the largest shareholder of the venture with 55% of the capital owned while the PBoC’s CNCC owns 34%. Ĭalled Finance Gateway Information Services Co, the new entity was created last month with a US$12 million incorporation capital to offer information system integration, data processing and technological consultancy among other functions. The Digital Currency Research Institute (DCRI) and the China National Clearing Centre (CNCC) within the People’s Bank of China (PBoC) signed the joint venture that shows China is exploring global use of its planned digital yuan, according to a Reuters report.

#CIPS CNY SWIFT SHARE SERIES#

After a series of major tests within its borders, China’s Digital Currency Electronic Payment (DCEP) project seems to be on the verge of being taken across borders following Thursday’s news of a joint venture with the global system for financial messaging and cross-border payments, SWIFT.

0 kommentar(er)

0 kommentar(er)